Uncf Best Buy Scholarship

Uncf Best Buy Scholarship - You only get interest from a savings account, such. You can have both a cash junior isa and a shares junior isa, as long as you don't put over £9,000 in per tax year. Every adult has a £20,000 isa allowance for 2025/26 and it's possible to use all or part of that isa allowance to invest in the stock market. It wouldn't make much sense for it not to be flexible given that the cash isa is. If you have money in a stocks and shares isa, then normally unsurprisingly, your money is invested in stocks and shares. Martin lewis explains what's likely to happen to the cash isa limit, what the changes would mean for savers, and what you should be doing now, in his latest video. But isas are simply accounts for your savings or investments that. Trading212 offers several different types of account, none of them are current accounts. You can put up to £20,000 in isas. According to the mse site, then if you opened a trading212 cash isa as a new customer today, you'd receive 4.9% variable interest, with a 0.13% interest boost, taking you. Every adult has a £20,000 isa allowance for 2025/26 and it's possible to use all or part of that isa allowance to invest in the stock market. Martin lewis explains what's likely to happen to the cash isa limit, what the changes would mean for savers, and what you should be doing now, in his latest video. You can have both a cash junior isa and a shares junior isa, as long as you don't put over £9,000 in per tax year. You can, and both platforms mentioned in this guide allow you to hold gilts within a stocks and shares isa with them. It wouldn't make much sense for it not to be flexible given that the cash isa is. However, always consider whether gilts are the best use of. You can put up to £20,000 in isas. This guide runs through what you. According to the mse site, then if you opened a trading212 cash isa as a new customer today, you'd receive 4.9% variable interest, with a 0.13% interest boost, taking you. But isas are simply accounts for your savings or investments that. Martin lewis explains what's likely to happen to the cash isa limit, what the changes would mean for savers, and what you should be doing now, in his latest video. You can put up to £20,000 in isas. This guide runs through what you. You only get interest from a savings account, such. It wouldn't make much sense for it. Every adult has a £20,000 isa allowance for 2025/26 and it's possible to use all or part of that isa allowance to invest in the stock market. However, always consider whether gilts are the best use of. You can put up to £20,000 in isas. You only get interest from a savings account, such. Many people think isas are complicated,. Every adult has a £20,000 isa allowance for 2025/26 and it's possible to use all or part of that isa allowance to invest in the stock market. But isas are simply accounts for your savings or investments that. However, always consider whether gilts are the best use of. It wouldn't make much sense for it not to be flexible given. Many people think isas are complicated, and that perception isn't helped by the maze of options out there. Every adult has a £20,000 isa allowance for 2025/26 and it's possible to use all or part of that isa allowance to invest in the stock market. You can, and both platforms mentioned in this guide allow you to hold gilts within. But isas are simply accounts for your savings or investments that. Many people think isas are complicated, and that perception isn't helped by the maze of options out there. If you have money in a stocks and shares isa, then normally unsurprisingly, your money is invested in stocks and shares. This guide runs through what you. You only get interest. You can, and both platforms mentioned in this guide allow you to hold gilts within a stocks and shares isa with them. Trading212 offers several different types of account, none of them are current accounts. You only get interest from a savings account, such. Martin lewis explains what's likely to happen to the cash isa limit, what the changes would. Martin lewis explains what's likely to happen to the cash isa limit, what the changes would mean for savers, and what you should be doing now, in his latest video. However, always consider whether gilts are the best use of. This guide runs through what you. You can, and both platforms mentioned in this guide allow you to hold gilts. If you have money in a stocks and shares isa, then normally unsurprisingly, your money is invested in stocks and shares. It wouldn't make much sense for it not to be flexible given that the cash isa is. This guide runs through what you. Every adult has a £20,000 isa allowance for 2025/26 and it's possible to use all or. Trading212 offers several different types of account, none of them are current accounts. Martin lewis explains what's likely to happen to the cash isa limit, what the changes would mean for savers, and what you should be doing now, in his latest video. However, always consider whether gilts are the best use of. According to the mse site, then if. You can have both a cash junior isa and a shares junior isa, as long as you don't put over £9,000 in per tax year. But isas are simply accounts for your savings or investments that. If you have money in a stocks and shares isa, then normally unsurprisingly, your money is invested in stocks and shares. You only get. Every adult has a £20,000 isa allowance for 2025/26 and it's possible to use all or part of that isa allowance to invest in the stock market. However, always consider whether gilts are the best use of. But isas are simply accounts for your savings or investments that. You can put up to £20,000 in isas. It wouldn't make much sense for it not to be flexible given that the cash isa is. Many people think isas are complicated, and that perception isn't helped by the maze of options out there. Trading212 offers several different types of account, none of them are current accounts. This guide runs through what you. If you have money in a stocks and shares isa, then normally unsurprisingly, your money is invested in stocks and shares. You only get interest from a savings account, such. Martin lewis explains what's likely to happen to the cash isa limit, what the changes would mean for savers, and what you should be doing now, in his latest video.College Career Coaching The 3 C's of Su"ccc"ess

UNCF Cincinnati Ready to apply for scholarships? Don’t miss these

JOIN US The NETwork BICP UNCF 2024 Scholarship Kick Off hosted by

UNCF Charlotte UNCF

Scholarships for Success The UNCF's Programs and Initiatives

Apply for the UNCF General Scholarship!

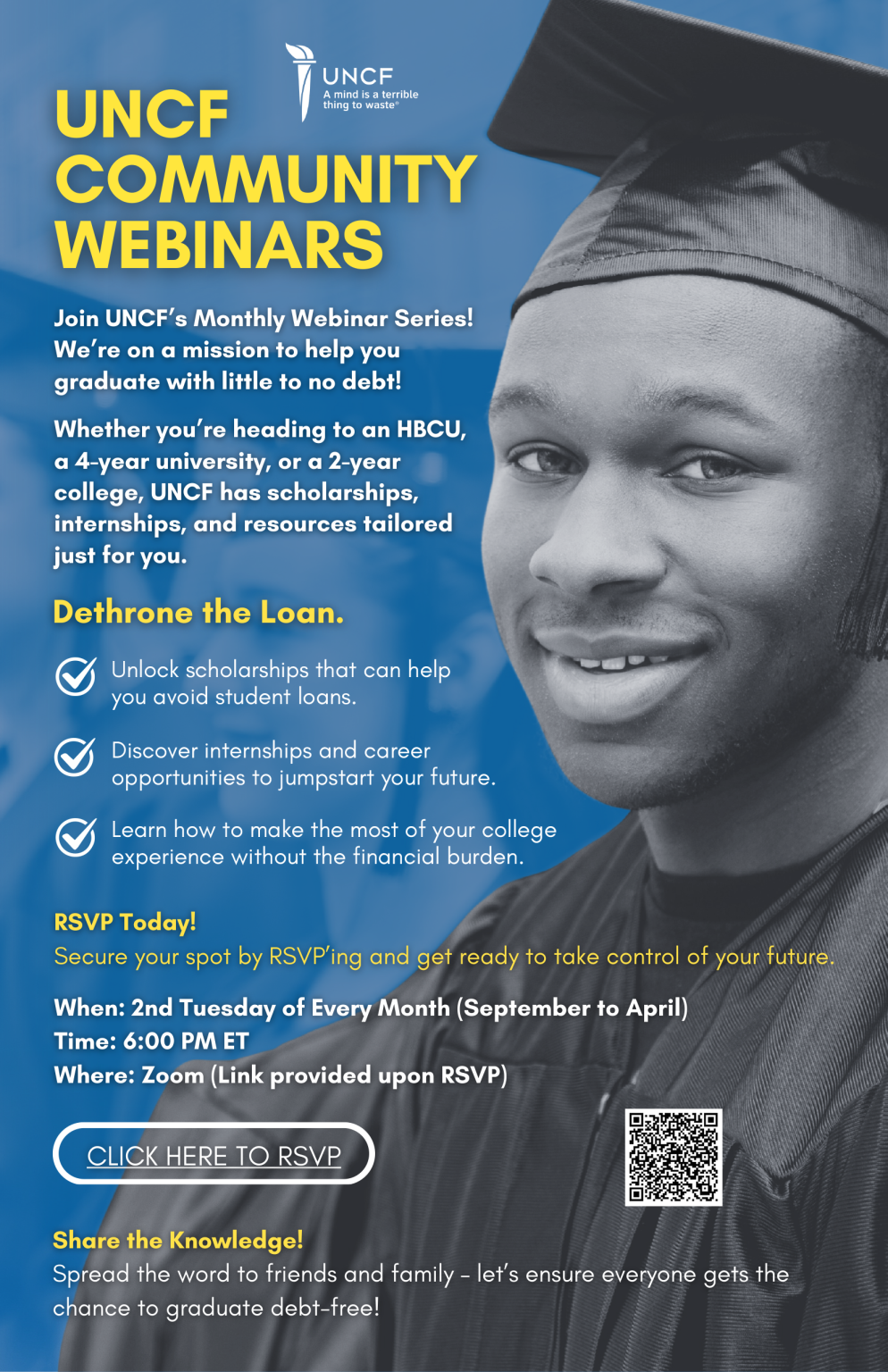

UNCF Offers Free Webinars Highlighting Scholarships UNCF

Montgomery County UNCF Scholarship Montgomery County, OH Official

UNCF Washington D.C. DC

Claflin University to Raise Money to Support Student Scholarships on

You Can, And Both Platforms Mentioned In This Guide Allow You To Hold Gilts Within A Stocks And Shares Isa With Them.

According To The Mse Site, Then If You Opened A Trading212 Cash Isa As A New Customer Today, You'd Receive 4.9% Variable Interest, With A 0.13% Interest Boost, Taking You.

You Can Have Both A Cash Junior Isa And A Shares Junior Isa, As Long As You Don't Put Over £9,000 In Per Tax Year.

Related Post: